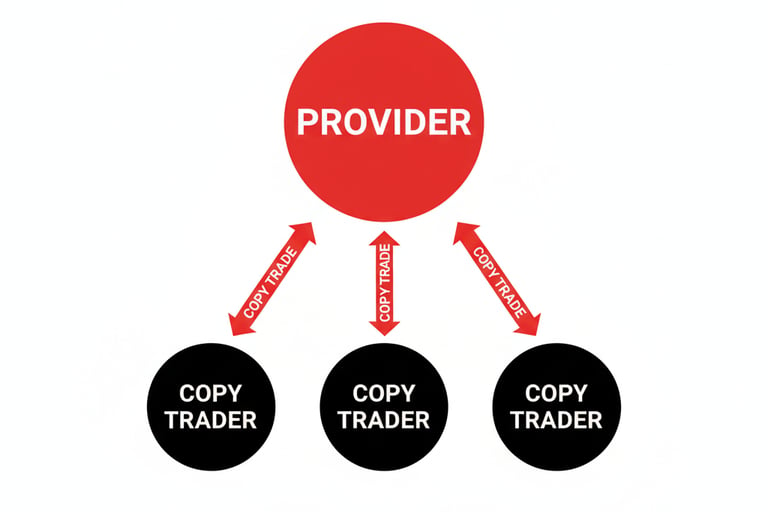

WHAT IS COPYTRADE

Understand copy trading before investing—follow experienced traders and trade smarter

Copytrade lets you automatically copy the trades of experienced professional traders. Every trade they execute is mirrored in your account according to the funds you allocate. With copy trading, you can benefit from expert trading strategies, learn from real market experience, and grow your investment—all without needing advanced trading knowledge.

THINGS YOU NEED TO KNOW BEFORE FOLLOWING PROFESSIONAL TRADERS

Copytrading is an easy way for beginners and busy traders to benefit from the strategies of professional traders without needing advanced trading knowledge. Every trade executed by a professional, also called a copy manager, is mirrored in your account based on the funds you allocate. This allows you to learn from real trading experience while potentially earning profits.

However, before you start copytrading, there are several important things you need to consider to trade safely and smartly.

1. Check the Type of Broker

Not all brokers support copy trading, and the type of broker you choose matters. Look for brokers that are regulated, trustworthy, and provide live chat support. Make sure the broker allows you to monitor your funds, set stop-loss limits, and withdraw easily. A reliable broker is the foundation of a safe copytrading experience.

2. Evaluate the Copy Manager

Before following a copy manager, research their performance carefully. Check:

Drawdown history: How much loss has the manager experienced in past trades?

Trading experience: How long have they been active in the market?

Consistency: Are their profits steady, or highly volatile?

Minimum deposit: How much do you need to allocate to start copying their trades?

Choosing the right copy manager reduces risks and helps you understand how professional traders approach the market.

3. Understand the Risks

Even the most experienced traders can have losses. Copytrading does not guarantee profits, and market risks are always present. Never invest money you cannot afford to lose. It is advisable to start with small amounts or use funds you can afford to spare.

4. Always Use Your Own Account

Never give money directly to a copy manager. Scammers often promise high returns if you hand over funds, but this is dangerous and illegal. Use a trusted copy trading platform linked to your own account. This ensures you maintain full control over your money while following the trades safely.

5. Learn While Copying

One of the biggest advantages of copytrading is the learning opportunity. By following experienced traders, you can see how they manage risk, place trades, and adjust strategies. Over time, this experience can help you develop your own trading skills and confidence.

Copytrading is a powerful tool for both beginners and busy traders, but it requires careful planning and understanding. Research your brokers and copy managers, understand the risks, use only extra funds, and always keep your money in your own account. By following these guidelines, you can maximize the potential of copy trading while staying safe.